Stopping fraud via IBAN Name Check

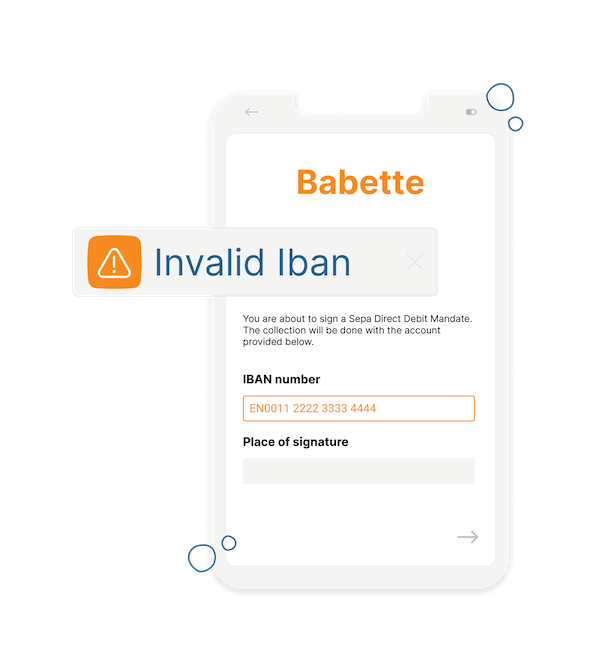

Paying the wrong person is frustrating. But when it’s part of a scam or phishing attack, the money is usually gone forever. Twikey’s IBAN Check protects you by verifying whether the account name really matches the IBAN.

Not the right name? No payment

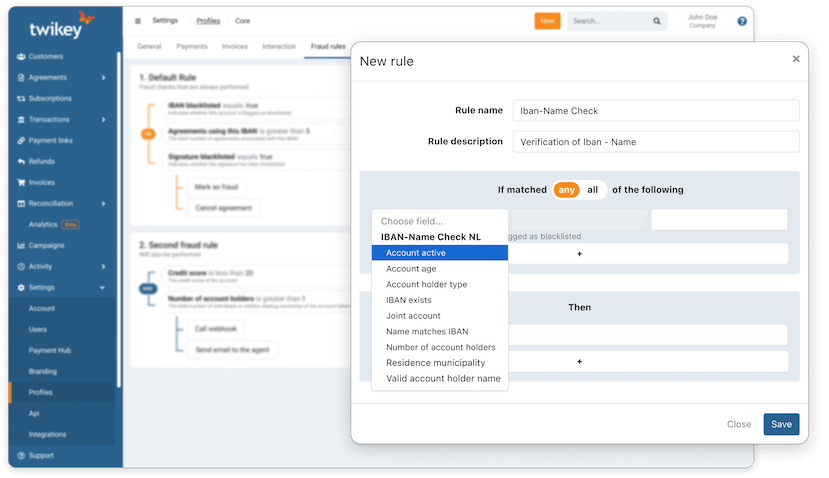

According to research, scams and phishing are affecting 1 in 4 European companies each year, so simple IBAN validation is no longer enough. From October 9 2025 onwards, banks are obliged to check more and must check the IBAN-name combination. However, this Verification of Payee (VoP) is too late in most cases. But Twikey can assist during the customer onboarding by matching the name of the beneficiary with the IBAN. Depending on the country and the underlying service, we can check the type of accountor company (business or non-business), age of the account holder, or how many people have access to the account.

Proven technology

With a lot of clients already running our IBAN Check feature in the Netherlands and Italy, we’re now rolling out this technology across other European countries like Belgium. IBAN Name Check is part of Twikey’s broader Fraud Detection portfolio and is a crucial building block in your anti-fraud firewall, which also includes options to blacklist accounts, set anti-fraud rules for mandates and other validation tools.

*Mandatory

Contact us

Leave your details and we will contact you as soon as possible.