How it works Start with direct debits or online payments in 5 simple steps

Step 1 Configure brand and profiles

Recognition creates reliability. The payment pages, emails, text messages and/or letters are adapted to your corporate identity.

Twikey is linked to European banks, Payment Service Providers and billing systems. Here’s how we link to settle your financial operations:

Direct debit: Your account is linked to your own bank and account.

Online payments: Your account will be linked to the most suitable Payment Service Provider(s).

Collect invoices: Twikey links to your ERP or accounting system

Step 2 Invite your customer

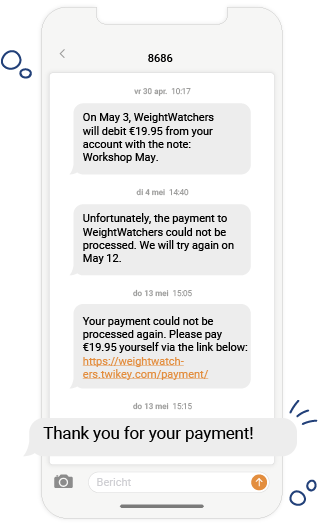

Make your choice between the different communication channels and outline the most effective customer journey. You can send an intelligent payment invitation via email, SMS, WhatsApp, along with your invoice and linked to your POS, a QR code or even through a call center.

Step 3 Your customer agrees

Direct debit: Your customer agrees online to the mandate and gives permission to collect money from his/her account. Future or variable amounts can also be collected automatically after this.

Online payments: Your customer chooses the payment method and agrees to a one-time payment. With a recurring credit card, you can debit periodically, just like a direct debit.

Step 4 Collect the money

Provide the correct payment instructions and Twikey will process the transactions through your bank.

Direct debits are collected on your own account. This means fast payment, clarity for your customers and fewer reversals. Online payments are also supported via payment providers. This way you are immediately sure of your payment.

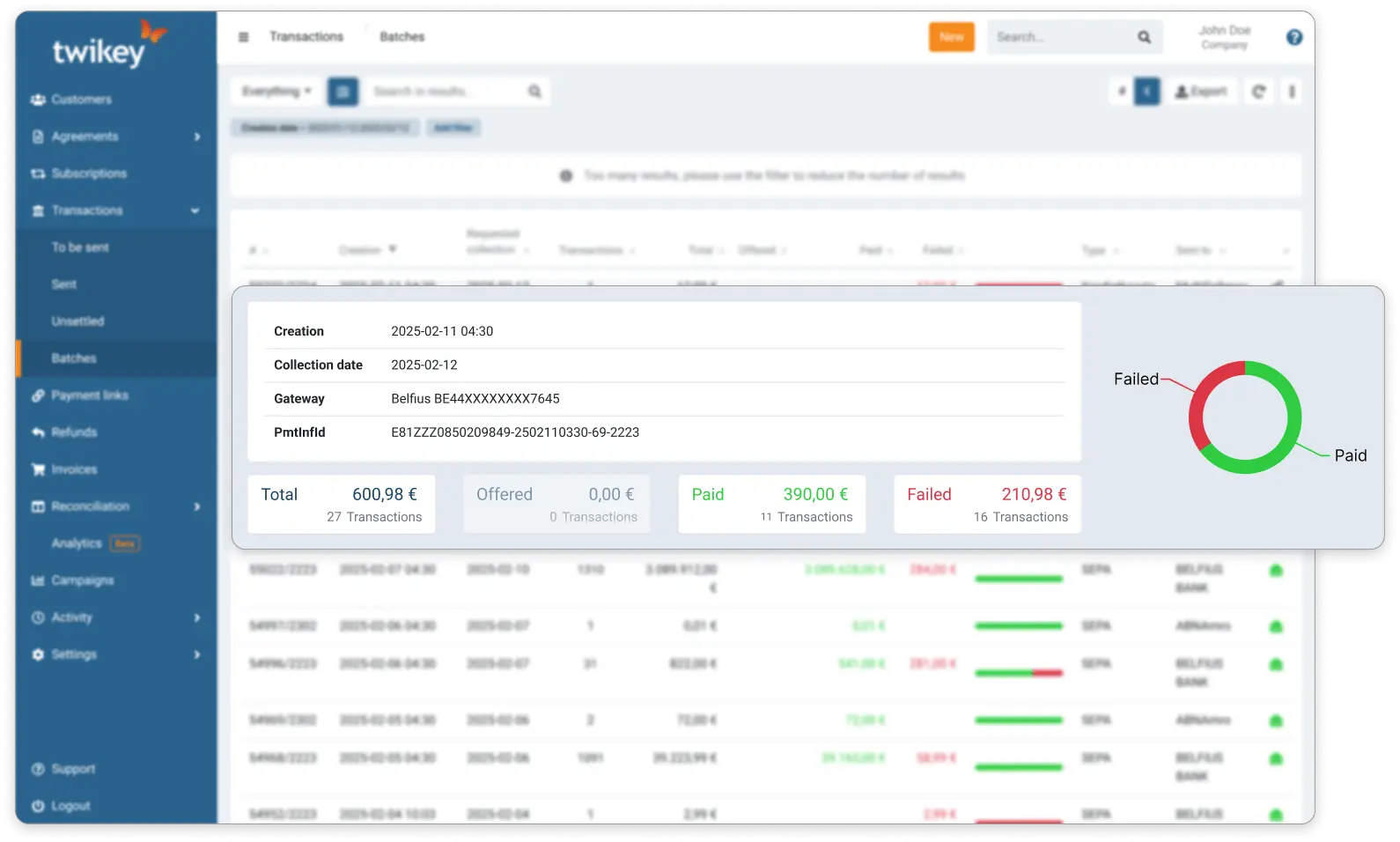

Step 5 Follow up, automate and monitor

For each customer, you have an overview of the payments per payment method. This reconciliation file ensures automatic processing in your own accounting software.

If a payment has not been made, the automatic follow-up system is started, so that you no longer have to spend time on your accounts receivable process.

Here's how you get started

Create an account

Through a short intake interview, we examine which payment solution can be of added value to you.

Configure

Everything is tailored to your wishes in collaboration with your bank or PSP.

Automation

Our Customer Success team helps you automate everything as much as possible.

They're already using Twikey

Want to know more?

We're here to help you.

*Mandatory

Contact our team

Leave your details and we will contact you as soon as possible.