E-mandates

Get your e-mandates legally signed online!

- Direct Debit E-mandate Signing

- Recurring Credit Card & PayPal Tokenization

- Online Archive

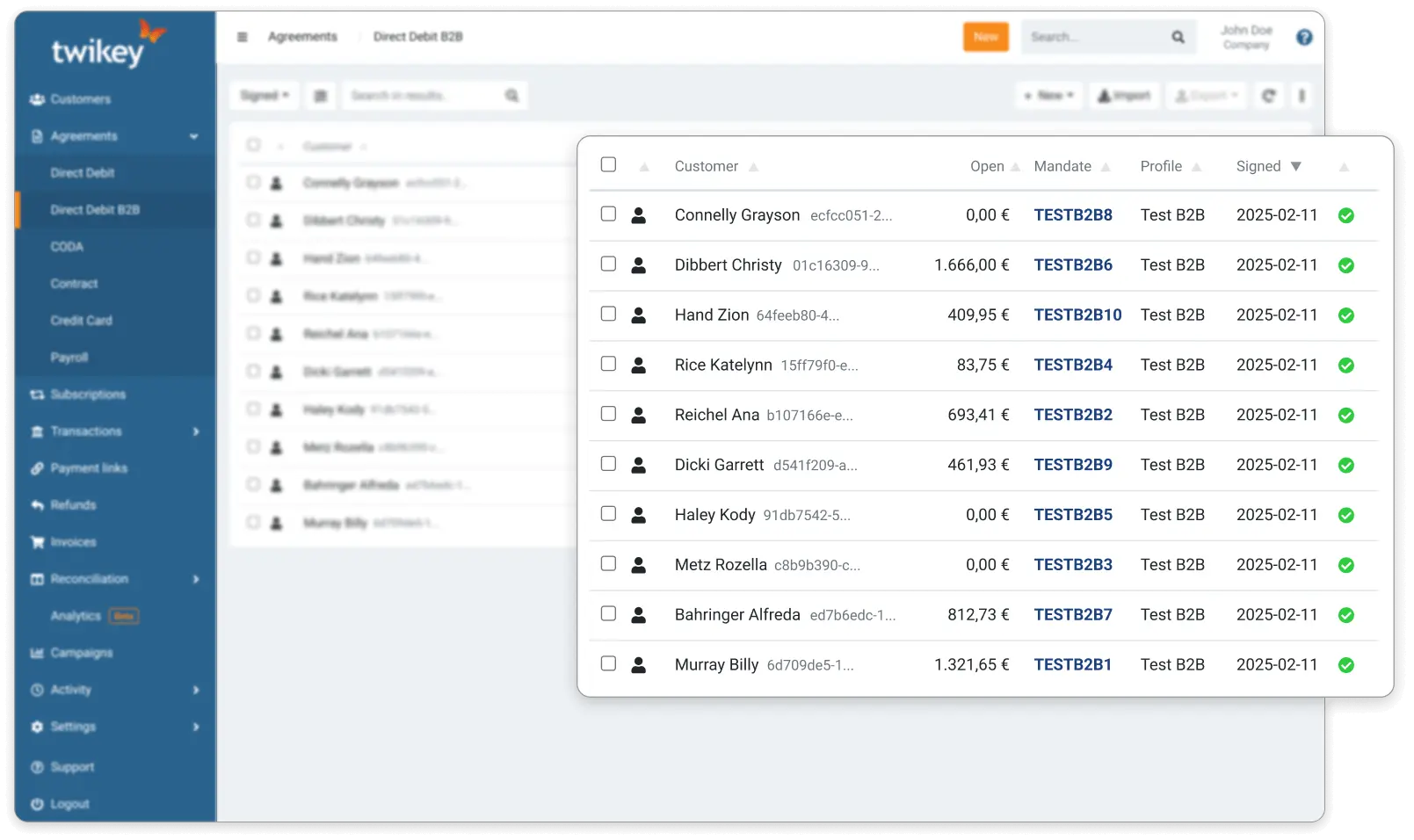

Unique Sepa Direct Debit Core & B2B-Mandate Signing

Thanks to our exclusive connections to banks, we provide the only platform for online B2B mandate signing. This empowers you to start collecting payments from other businesses securely and efficiently with ease.

The SEPA Direct Debit Core (SDD Core) and SEPA Direct Debit B2B (SDD B2B) play a crucial role in facilitating regular payments for recurring financial commitments. While SDD Core covers all direct debit transactions, SDD B2B focuses specifically on recurring transactions between businesses.

Core direct debits B2B direct debitsWhy e-mandates?

E-mandates are digital authorisations designed for secure, hassle-free recurring payments. With easy setup and direct linkage to your bank account, e-mandates not only save time but also significantly cut down on paperwork.

They offer threefold benefits: enhanced efficiency by automating transactions, improved security against unauthorized activities, and superior customer retention through a streamlined payment process. By adopting e-Mandates, businesses can focus more on growth and less on administrative tasks.

Recurring Credit Card and PayPal Tokenization

Credit card & PayPal tokenization is a powerful tool that can greatly benefit businesses with recurrences and subscriptions. Tokenization works by substituting sensitive cardholder account numbers with randomly generated tokens. These tokens act as stand-ins for the actual credit card information, ensuring that customer data remains protected. This process is particularly useful for businesses that need to keep customers' cards on file for recurring payments or subscription billing.

The benefits of using credit card tokenization for recurrences and subscriptions are evident. It provides enhanced security, protects customer data, and reduces the risk of fraud. Additionally, it offers operational efficiency by simplifying payment processing and compliance requirements.

Manage and Secure Your Signed E-mandates and Contracts

Our legal archive tool is an essential feature of our e-mandate solution. It provides a secure and centralised repository for storing and managing signed e-mandates and contracts, ensuring organisation and compliance. With advanced search capabilities, customisable access controls, and seamless integration, the Legal Archive simplifies team collaboration and streamlines operations.

We guarantee the continuous updating of mandates, which covers changes to bank account or card numbers, connections with bank switching services, as well as updates or cancellations.

Our partnersInteresting for every Industry

Discover the sectors in which we are already active

Wholesale

Energy suppliers

E-commerce companies

Telecom providers

IT and software

Accountants

Employment agencies

(Sports) associations

Care sector and hospitals

B2B suppliers

Want to know more?

We're here to help you.

*Mandatory

Contact our team

Leave your details and we will contact you as soon as possible.