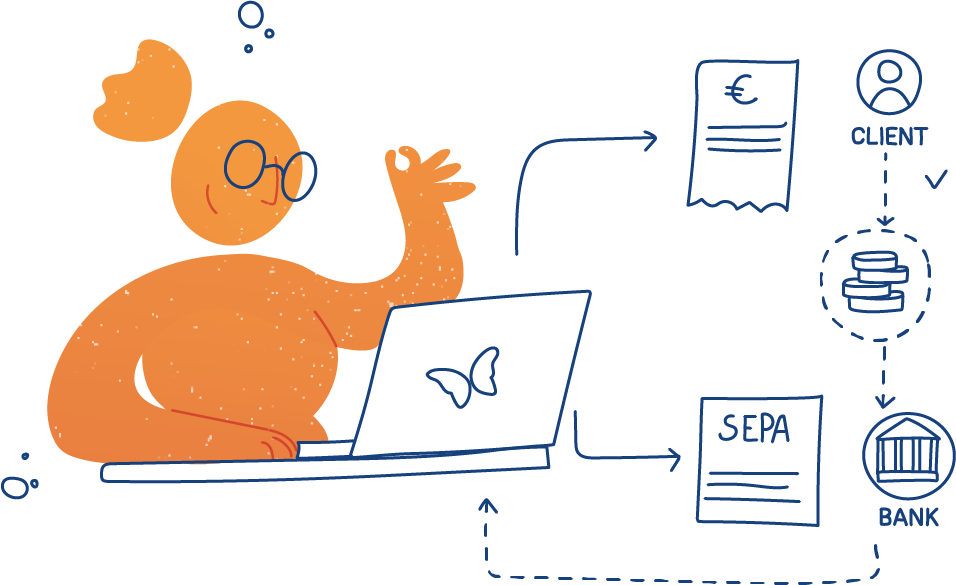

Sepa Direct Debits

The ultimate solution for effortless and efficient recurring payments

- Cost efficiency

- Wide geographical coverage

- Enhanced payment control

Link directly to your bank account

Boost your business with SEPA Direct Debit

Seamlessly collect payments from your customers' bank accounts, eliminating the need for manual processing and reducing administrative tasks. With secure and efficient payments, you can focus on growing your business and providing an exceptional customer experience.

Take advantage of the convenience and reliability of SEPA Direct Debit to streamline your payment processes and unlock new opportunities.

Sepa Direct Debit Core & B2B

A direct debit is an authorisation given in the form of a mandate to a creditor (companies or institutions) allowing you to automatically collect money from the debtor's account. The payment initiative always comes from the creditor. We distinguish 2 types of direct debits: CORE & B2B direct debits.

SDD B2B mandates can only be concluded between companies. CORE agreements, on the other hand, can be concluded both between companies and individuals and between companies themselves. The biggest difference between these two payment methods is that a transaction on a CORE direct debit mandate, unlike a B2B direct debit, can be reversed for 8 weeks.

SEPA Core Direct Debit

- Designed for both B2B and B2C transactions

- Commonly used for low-value transactions

- Customers (payers) can request a refund within 8 weeks of payment

- If the payment mandate was incorrect or unauthorized, customers have an extended period of 13 months to request a refund

- No registration of the mandates at the payer's bank is required

SEPA B2B Direct Debit

- Specifically designed for B2B transactions

- Typically used for higher-value transactions between businesses

- Refunds are generally not available for authorized transactions

- Payers must undergo mandatory pre-registration and obtain confirmation from their bank

- Provides a secure and reliable payment method for B2B transactions

Interesting for every Industry

Discover the sectors in which we are already active

Wholesale

Energy suppliers

E-commerce companies

Telecom providers

IT and software

Accountants

Employment agencies

(Sports) associations

Care sector and hospitals

B2B suppliers

Want to know more?

We're here to help you.

*Mandatory

Contact our team

Leave your details and we will contact you as soon as possible.

Do you represent a company?*