Enhance security with digital customer identification

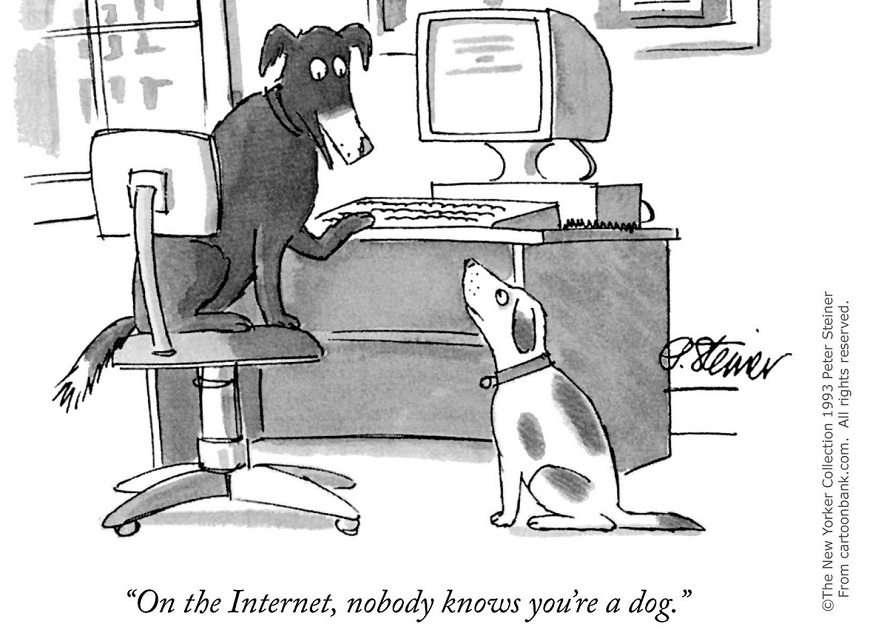

Doing business online offers many opportunities. The importance of the digital sales channel is increasing rapidly - and with it the need for payment security. Internet trading is in some cases fraud sensitive. How do you know for sure who your customer is? A passport based legitimation is not an option in the digital world. A gap in the market the banks were keen to fill.

Is it correct?

How ideal would it be if your customers could identify themselves online? Many web entrepreneurs would like to be sure that the customer details provided are correct before sending the ordered goods. For online liquor stores, it is important to be sure that their customer is indeed at least 18 years old. For digital content providers such as Netflix and Spotify, the e-mail address of their customer is also the delivery address. To prevent fraud and abuse, it is important for them to know that the email address provided really belongs to the customer involved.

Check through the bank for Dutch and Belgian clients

Fortunately, iDIN (Identification Initial) has recently been introduced: this is**a new service offered by the banks since the end of 2016 which allows consumers to identify themselves online with other organizations. The basic principle is simple: anyone who wants to open a bank account must identify himself. The bank has already carried out this check.**With iDIN you can use this check and have your customer confirm his identity online. This is reliable, convenient and fast!

In Belgium there is also Itsme : an initiative of the Belgian banks (BNP Paribas Fortis, ING, KBC and Belfius) and the three major telecom providers (Proximus, Telenet and Orange), which allows the linking of the bank details and the SIM card data. Online identification via Itsme is possible since the end of May 2017. In addition to the Belgian eID that already existed for a while, this is a very interesting service especially for mobile users.

More conversion!

The use of digital identification methods such as iDIN, Itsme & eID offers a great protection against identity fraud. But they also offer another major advantage: by logging in with iDIN & Itsme, your customer does not have to enter all kinds of personal information, such as his name, street, postal code town and date of birth. This makes it particularly convenient for your customer, especially when using his smartphone. And as a web entrepreneur you also know: the more convenience, the more conversion!

Which data?

iDIN and Itsme both allow to receive the first name, last name, street, zip code, town, country, date of birth, gender, nationality. Both systems also provide country-dependent additional options. You can also use this information in your "funnel" to work out a personalized offer afterwards.

How to start with this?

You can set up an integration with iDIN or Itsme yourself. Consider an implementation time of a few weeks per method. In addition, there is also the necessary paperwork with the bank (for iDIN) or with Itsme to be settled. Or you can work together with a partner like Twikey ...

Twikey, iDIN & Itsme: a strong combination

With iDIN & Itsme you have new tools at your disposal to accept customers online, improve your security and reduce your debtor risk, while offering an extra service to your customers. Twikey already has the technology ready for you in combination with a very simple API. Together with Twikey, nothing stands in the way of doing business online as safely as possible. You immediately have a solution for the Netherlands and Belgium and save weeks of development time.

If you also want maximum security and maximum conversion, please contact our specialists without any obligation!