Streamline Direct Debits with the bank switching service

On February 1, 2018, the banks will offer a new additional tool to support recurring automatic payments and Direct Debits. The Bankswitching service makes it possible to automatically inform the supplier when a customer changes banks. The end customer can himself indicate whether he wishes this to be done or not.

What does this mean for the end customer?

When an end customer changes banks, he can decide to transfer all his standing payment orders and active Direct Debits from his actual bank to his new bank. He no longer has to ask this to his old bank. His new bank will take care of the transfer. This is a free service for the end customer.

How is the supplier informed?

The supplier must first of all know that the Direct Debit has been transferred. At the next collection, he must be able to indicate that the amount must be collected from another account. The supplier can be informed of the transfer in several ways.

- Via a paper flow: the supplier's bank can provide him a paper document with the data relating to the account number change. This is the mandate number, the new and old account number and the date of the transfer.

- Via a FTP connection: the supplier can request the setup of a FTP connection via the website of Febelfin to automatically receive the files with the transfer information. The information thus obtained will consist of a CSV file and a PDF. The CSV file contains all the details of the transfer of the mandate as well as the old and the new account number. The PDF lists the same data.

- The supplier can also receive the same information via Zoomit .

- Or via Twikey and this via an advanced methodology: API. Twikey has an "Update API" that will return old and new data in a clear way. This can be done in JSON or XML depending on the supplier’s preferences.

For option 1, " paper ", the supplier must do nothing. He will receive the transfer document from his bank.

For options 2 and 3 ( FTP or Zoomit ), the supplier will have to submit his request via the Febelfin website.

For option 4 (Twikey), Twikey takes care of everything. The supplier must only have a Twikey subscription. Twikey has chosen to include this service in all its subscriptions. Existing Twikey customers naturally only need to submit a request for this service via our integration page. As soon as the connection with the Bankswitching service has been set up, they will automatically receive an update of all the mandates through the API or by email.

How to process this in the Sepa Direct Debit XML?

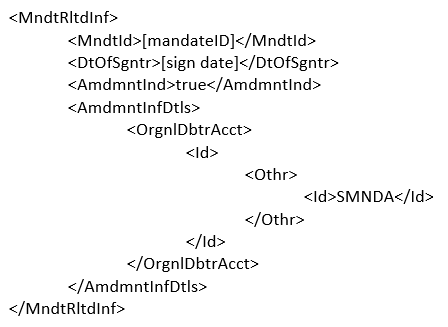

As soon as a creditor has been informed that his customer has changed banks, he must include this change in the next Sepa Direct Debit file that is created. In concrete terms, this means that an amendment must be made that is passed on to the bank.

The new IBAN must be added in the "debtor iban" DebtorAccount <DbtrAcct> tag.

Across borders?

A Bankswitching service can only be effectively organized in one country. In addition, an account is rarely transferred from one country to another. A resident of a country usually has a bank account in the same country. In the future, there will naturally be more players who will compete with our local banker with very accessible solutions and PSD2 (API access to a bank account). For the moment, there is stillno ground for a European Bankswitching service.

The creation of this service was originally an idea of a group of European experts who, in 2006, planned to set it up for each country of the European community. In Belgium, all retail banks offer this service.

Do you also want to start with this service?

We deliver the data via API or email depending on the settings. On our API page, the mandate update API is important. It is responsible for the automatic update of the data of existing mandates. You can easily start via our page.