Direct Debits during a company takeover

Company takeover or merger? What to do with Direct Debits

A company takeover or merger has a major impact on the operation of a company and creates a lot of additional administration. It is important to keep the administration to a minimum. For recurring payments by Direct Debit, there are numerous options to ensure that the payment flow continues to run smoothly without administrative hassle and without having to bother the end customer. Not all existing Direct Debits of the acquired company need to be renewed. We list the possibilities for you.

Importance of the bank

The process for taking over Direct Debit mandates depends mainly on the bank. If a bank can transfer the existing portfolio of creditor numbers, the acquisition is very simple and it suffices to communicate to the customer that future invoices will be collected by another company. The creditor number moves from one firm to another and the bank adjusts the creditor's account number if necessary. Not all banks support this process. So consult multiple banks to avoid a migration process.

If the bank cannot transfer the creditor number, it becomes a bit more complicated. The acquisition process of the mandates then depends on the type of mandate. We distinguish a method for core mandates (can be used by individuals and professionals) and B2B mandates (can only be used by professionals (non-consumer)).

Acquisition of core mandates

Core mandates can be migrated by the merchant himself. Most accounting packages do not have the ability to perform this migration and refer companies to Twikey. Via Twikey it is possible to migrate the mandates from the old creditor number to the new one. The mandate itself does not need to be reformatted, signed and validated. You only need to communicate the new creditor number and name of the new creditor to the end customer.

Acquisition of B2B mandates

This method does not apply to B2B mandates. Experience tells us that banks cannot guarantee correct registration of migrated B2B mandates. We therefore recommend that you renegotiate and renew these mandates. All customers will then be invited to sign a new mandate. You can launch a conversion campaign via Twikey and invite your customers (1 by 1 or in bulk) to easily sign a Direct Debit mandate online and pay future invoices via Direct Debit. A successful conversion campaign can be conducted through:

- letter campaigns (via a unique code on the letter, customers are redirected to a personalized space where all their contact details are automatically pre-filled. The customer only needs to give his consent by signing the mandate online.)

- a portal on your own website.

By using our app, you can easily monitor the campaign and automatically sent reminders. We advise you to temporarily use the old existing Direct Debit flow with the old creditor number pending the migration of the new mandates. By doing so, you will maintain the existing revenue stream and will not be reliant on the action of the end customer.

Summary

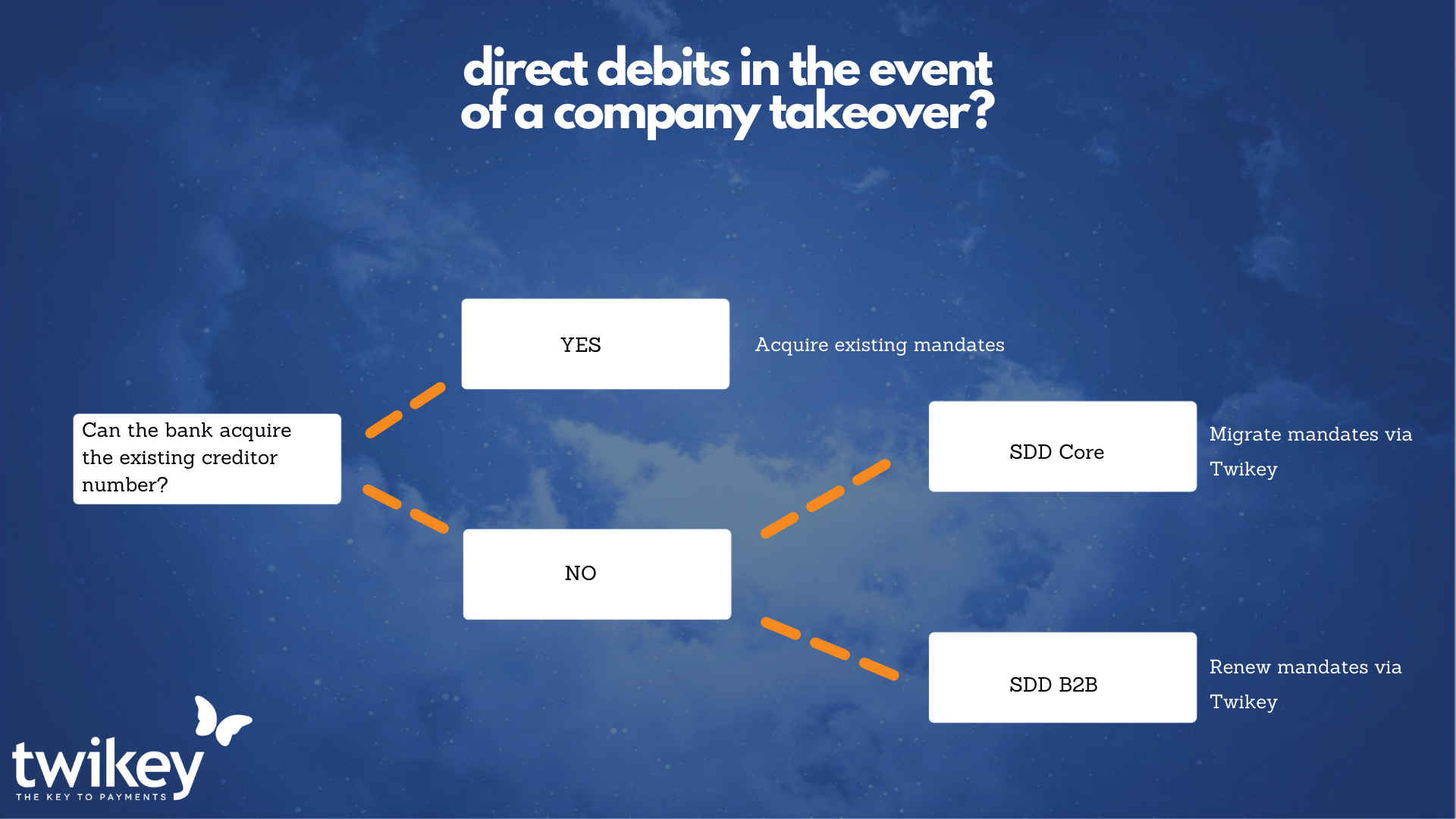

The process of taking over Direct Debits in case of a company acquisition is mainly determined by the bank and the type of mandate (core mandate and B2B mandate). If a bank can acquire the creditor number, the existing mandates can also be adopted immediately. If a bank cannot acquire the creditor number, core mandates are taken over via migration and B2B mandates have to be renewed. Please find an overview below.

Do you have any questions? Twikey helps companies with their recurring payments and Direct Debit processes. Click here for a no-obligation conversation.